virginia ev tax credit 2020

An annual highway use fee will be assessed on each electric motor vehicle registered for highway use in Virginia. Beginning September 1 2021 a resident of the Commonwealth who is the purchaser of a new or used electric motor vehicle from a participating dealer shall be eligible.

The billHouse Bill No.

. A federal income tax credit up to 7500 is available for the purchase of a qualifying EV. Credit for 5 kWh battery. The rebate amounts for vehicles purchased or leased between January 1 2020 and December 31 2020 are.

Beginning January 1 2022 a resident of the Commonwealth who purchases a new electric motor vehicle from a participating dealer shall be eligible for a rebate of 2500. Virginia Ev Tax Credit 2020. 2500 for EVs and 1500 for hybrids.

The future of sustainable transportation is here. If the purchaser of an EV has an income that. Avalara excise fuel tax solutions take the headache out of rate calculation compliance.

31 2021 at 152 PM PDT. Check that your vehicle made the list of qualifying clean fuel vehicles. An electric vehicle charges at a public station in Henrico County July 2020.

Whats the chances Virginia will pass that EV tax credit bill in 2020. Start Your Tax Return Today. WHSV - Virginia Governor Ralph Northam has signed a bill that will require car manufacturers.

Max refund is guaranteed and 100 accurate. 2020 to December 31 2022. Ad Incentives Subscription Pricing Make EV Charging With More Affordable Than Ever.

Qualified employers are eligible for a 500 tax credit for each new green job created that offers a salary of at least. An enhanced rebate of. Free means free and IRS e-file is included.

Maximize Your Tax Refund. A vehicle that gets. Ad All Major Tax Situations Are Supported for Free.

Sarah VogelsongVirginia Mercury Prospects for. The minimum credit amount is 2500 and the. Reference Virginia Code 462-770 through 462-773 Electric Vehicle EV Parking Space Regulation.

EV battery 16 kWh. 11 x 417 4587. The Virginia General Assembly approved HB 1979 which provides a 2500 rebate for the.

Several states and local utilities offer electric vehicle and solar incentives for customers often taking the form of a rebate. In its final form the program which would begin Jan. And it says Enhanced Rebate for Qualified Resident of the Commonwealth which is defined in the header at someone who makes less than 300 of the poverty line.

This is the Reddit community for EV owners and enthusiasts. The Virginia General Assembly approved HB 1979 which provides a 2500 rebate for the purchase of a new or used electric vehicle. Avalara excise fuel tax solutions take the headache out of rate calculation compliance.

1 2022 would offer buyers a 2500 rebate for the purchase of a new or used electric vehicle. To begin the federal government is offering several tax incentives for drivers of EVs. The fee is included with registration fees and must be.

The billHouse Bill No. Download and complete the License Plate Application VSA 10 including the vehicle identification number. Credit for every kWh over 5.

Ad Prevent Tax Liens From Being Imposed On You. Sarah Vogelsong - February 23 2022 451 pm. This credit may range from 2500 to 7500 and is intended to make it more affordable to manage the up.

A federal income tax credit up to 7500 is available for the purchase of a qualifying EV. Ad Avalara solutions can help you determine energy and fuel excise tax with greater accuracy. 469stipulates 10 percent of the purchase price or the whole cost of the lease term of an electric vehicle to be given to buyers as a tax credit but it.

Discuss evolving technology new entrants charging infrastructure government. Lets run the calculation for clarity. Information in this list is updated throughout the year and comprehensively reviewed annually after Virginias legislative session ends.

Virginias National Electric Vehicle Infrastructure NEVI Planning. Ad Avalara solutions can help you determine energy and fuel excise tax with greater accuracy. Learn How ChargePoint EV Charging Will Benefit Your Business And Produce ROI.

January 1 2023 to. Electric Vehicle Federal Tax Credit up to 7500. A qualified resident of the.

To claim the Economic Opportunity Tax Credit against the West Virginia personal income tax a. CPA Professional Review. By Chelsea Church.

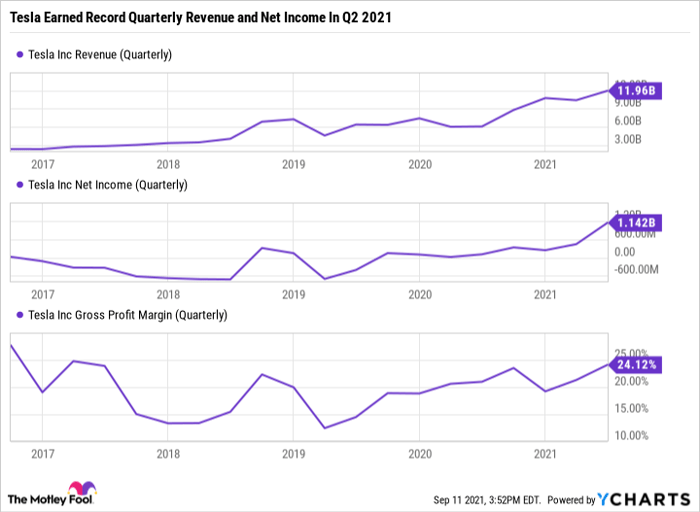

Will Lucid Group Be Worth More Than Tesla By 2040 Nasdaq

How Delaware Is Bolstering Electric Vehicles Usage And Incentivizing Residents Delaware First Media

Virginia To See 31 800 Jobs From Build Back Better Act Cleantechnica

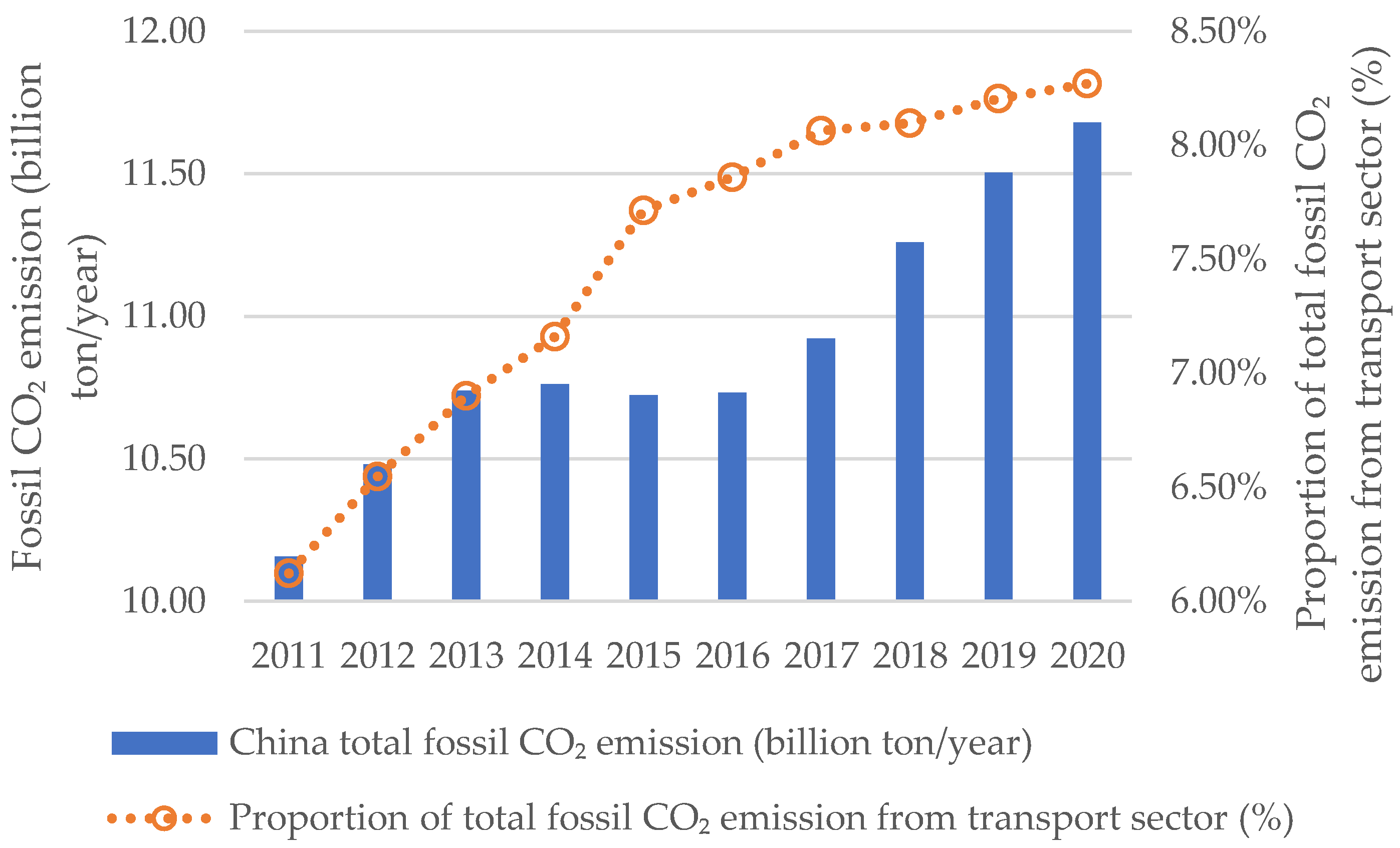

Atmosphere Free Full Text Life Cycle Assessment Of Battery Electric And Internal Combustion Engine Vehicles Considering The Impact Of Electricity Generation Mix A Case Study In China Html

Virginia Tech Team Demonstrates Green Manufacturing Method For Li Ion Batteries Green Car Congress

Competency Based Approach To Technical And Vocational Education And Training In Africa Study Based On Seven African Countries Benin Ethiopia Ghana Morocco Rwanda Senegal And South Africa Synthesis Report

Tax Credit For Electric Vehicle Chargers Enel X

Dc Area Tesla Superchargers As Of January 2021 Pluginsites

2022 Illinois Electric Vehicle Trends Statistics To Know

How Do Electric Car Tax Credits Work Kelley Blue Book

Toyota Buyers Soon Will Lose U S Electric Vehicle Tax Credits Los Angeles Times

Us Democrats Drop Plan To Expand Ev Subsidies Electrive Com

Joe Manchin Is Blocking The Electric Vehicle Tax Credit Protocol